About

Sandon Capital was founded in April 2008 in response to what I saw was a need for a more active approach to value investing in Australia.

Earlier in my career as a fund manager, I always exercised the discipline of conducting post-mortem assessments on shareholdings to establish what had gone to plan, and what had not. It became obvious to me that when an investment had not gone to plan, the outcomes may have been better had I tried to influence the company to do things differently.

I quickly learned that active engagement was not the approach of a traditional investment firm employer and the majority of Australian fund managers. Having always been influenced by the British-born American economist, Benjamin Graham (1894-1976), widely known as the “father of value investing” but far less known as one of the first activist investors, I decided to follow my conviction. I set up my own investment firm, Sandon Capital.

It was an opportune time. June 2008 was the mid-point of the global financial crisis and quality shares were being sold off by nervous investors. Backed by a number of forward thinking (and brave!) high net worth investors, in September 2009 I launched the Sandon Capital Activist Fund and began applying what has become known as Sandon Capital’s investment philosophy. Since that time, this approach has been proven during both the highs and the lows of the market cycle.

Gabriel Radzyminski

Founder, Managing Director & Chief Investment Officer

We don’t leave success to chance.

OUR INVESTMENT PHILOSOPHY

Sandon Capital is a value investor and employs active engagement to achieve exceptional shareholder returns.

We invest in undervalued and underperforming companies, predominantly in Australia, and seek to actively engage with their boards and other shareholders to implement operational and strategic initiatives which may generate value for the benefit of shareholders.

We do not believe anyone can predict the future, but with our philosophy of active engagement, we can certainly influence what the future might look like. Our approach is to help realise, not just identify, value in companies by becoming actively involved in influencing changes to their strategy. We do not leave success to chance and this allows us to achieve our goal of delivering exceptional returns for our investors.

We realise value by taking a proactive approach.

We focus on engaging to maximise the certainty of our value creation strategies.

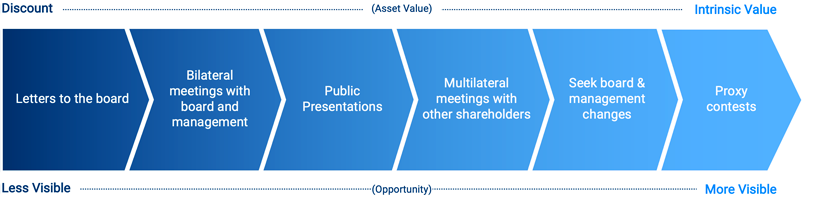

We adapt to each unique situation, employing both a range of visible and less visible techniques.

Good governance. Opportunity.

Action. Patience. Integrity.

Hear more about our activist approach.

Leadership

Led by a team with decades of success

Gabriel Radzyminski

Founder, Managing Director & Chief Investment Officer

Having commenced his career in the funds management sector in 1996, Gabriel has been successfully applying his unique investment approach at Sandon Capital since it was founded in 2008.

Gabriel is Chairman of Sandon Capital Investments Limited (ASX:SNC). As an activist investor he has held a number of board positions, including: Armidale Investment Company Limited (now known as COG Financial Service Ltd (ASX:COG); RHG Limited (ASX:RHG); Australian Infrastructure Fund (ASX:AIX); Chesser Resources Limited (ASX:CHZ) and Reverse Corp Ltd (ASX: REF) (current).

Gabriel is also a Non-Executive Director of Future Generation Investment Company Limited (ASX:FGX), through which Sandon Capital donates manager fees to provide financial support to Australian charities focused on children and youth at risk.

Gabriel has a Bachelor of Arts (Hons) and Masters of Commerce from the University of New South Wales.

Campbell Morgan

Portfolio Manager

Campbell is an owner of Sandon Capital and has over 20 years of experience in domestic and international financial markets.

Campbell commenced his career at ANZ in 2001 before moving to Merrill Lynch in 2003 to work in Equity Research where he was a top 3 rated analyst. In 2007, he moved to the United States to work in alternative funds management, joining Citadel Investment Group, a Chicago domiciled hedge fund with >US$30bn assets under management. Following this, he moved to New York in 2010 to take up a role managing a global materials portfolio for Millennium Management, a hedge fund with >US$40bn under management.

On returning to Australia in 2014, Campbell joined Sandon Capital. Campbell has a Bachelor of Commerce and a Bachelor of Science from the University of Melbourne.

Derek Skeen

Chief Operating Officer

Derek is the Chief Operating Officer of Sandon Capital and has over 25 years experience in the asset management industry.

Derek commenced his career at Macquarie Bank in 1995 and over the proceeding 25 years held increasingly senior roles in the Macquarie Asset Management division as the business grew organically and through acquisition. Derek’s career has seen him develop deep operational, risk management and product experience where he has led significant business strategy and transformation programs. Derek has held regulatory and board related positions over his career and has worked in and across a variety of regions for Macquarie Asset Management including in his role as Chief Operating Officer – APAC and, most recently, as Global Head of Investment Operations.

Derek has a Master of Business Administration from the University of New South Wales, Australian Graduate School of Management.

FINANCE & OPERATIONS

Lissa Cheng

Senior Accountant

Lissa is the firm’s Chartered Accountant and manages the accounting function of Sandon Capital. Prior to joining Sandon Capital in 2016, she worked at AMP Capital in accounting operations, compliance and audit management roles for nine years. Lissa has been working in the financial services sector since 2000. She holds a Bachelor of Business (Hons) in Accounting from Wollongong University and is conversational in Cantonese.

Estela Alvear

Senior Accountant

Estela joined Sandon Capital in 2018 as a senior financial accountant and provides support on all aspects of management and statutory reporting. She brings more than 10 years’ experience in financial and managerial accounting practice. Estela holds a graduate certificate in accounting from the University of Technology Sydney and is fluent in Spanish.

Susanne Trajkovski

Office Manager & Operations

Susanne manages the Sandon office and operations, and provides trade settlements and sales and accounting support. She joined Sandon Capital in 2019 and brings 11 years’ experience in similar roles at Bloomberg and its subsidiaries. Susanne is a native German speaker and proficient in French and Spanish.

Article

Shareholder Activism in Australia

In this Firstlinks article Gabriel Radzyminski, Sandon Capital Founder, Managing Director and Portfolio Manager, describes how activist investing plays an important role in building the efficiency of Australian capital markets and in protecting and enhancing common shareholder wealth.

Lobbying

Australian Treasury Consultation Paper

Sandon Capital’s submission to the Australian Government Treasury Department’s Consultation Paper on safeguarding good corporate governance by providing greater transparency of proxy advice, April 2021.